Scam of the Month: Putting the Broke in Mortgage Broker

Scam of the Month

A favorite feature of our Monthly Newsletter, now on the Blog!

Curious about the Newsletter?

Once a month, you get an email with this and other great News you can Use, handwritten by Actual People! Like Me!

A Silicon Valley executive put down her life savings on her dream house, only to realize a day later that she had lost both her savings and her dream. As a professional with 25 years of experience in technology and cybersecurity, she has a message:

Wire fraud can happen to anyone.

Here is her story.

Rana Robillard was thrilled to be the winning bidder on a newly renovated home in the highly competitive real estate market around San Francisco. After a yearlong search, she thought she finally had found a home for herself and her daughter.

So when she got an email from her mortgage broker to wire her nearly $400,000 down payment to a JP Morgan Chase account, she did so right away. The email appeared to be in response to an email she had sent to her broker asking about closing details, so she didn't question it. Until she got another request for the down payment.

That's when she realized she'd been had. And the panic set in.

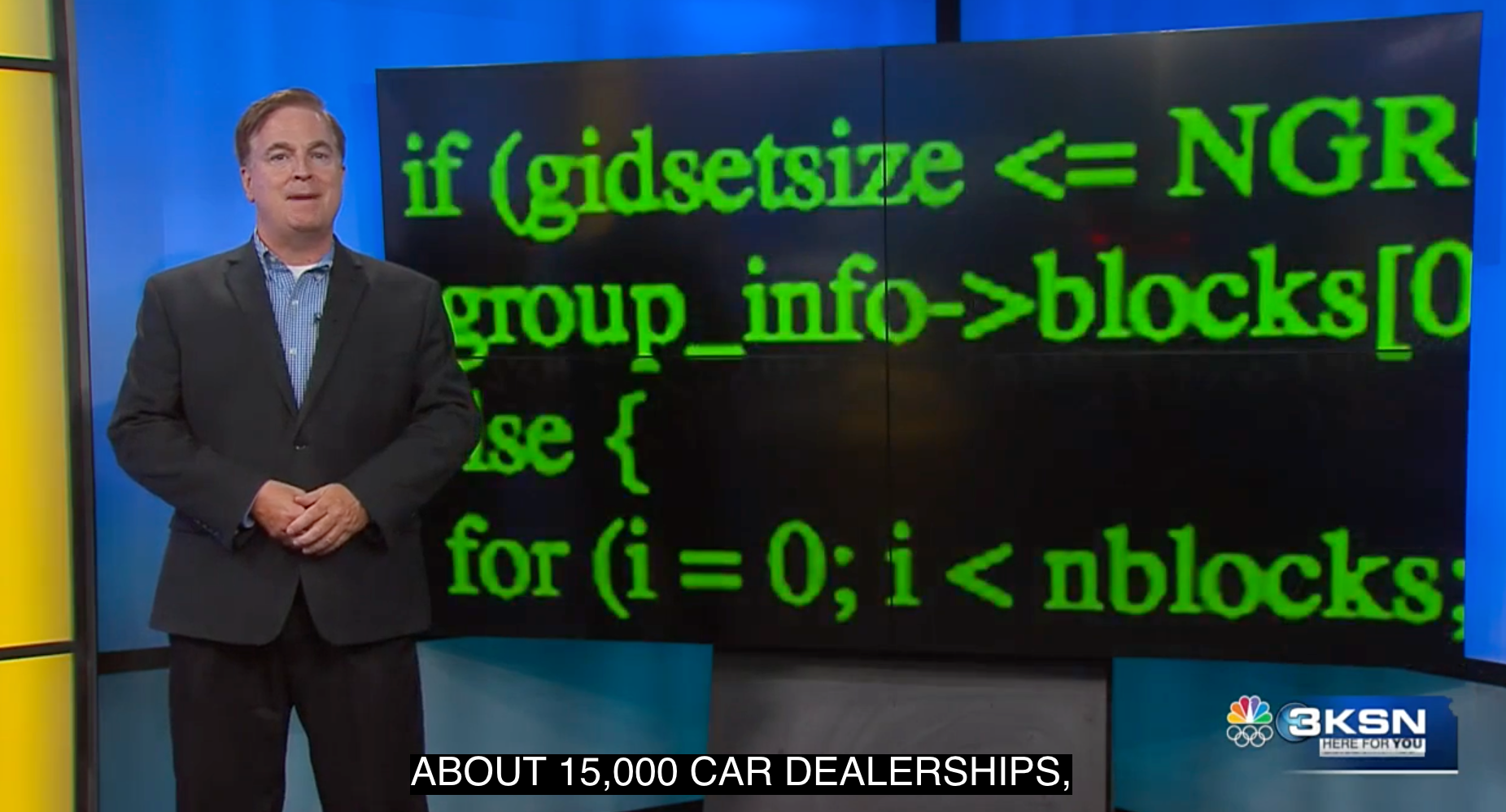

Wire transfers, commonly used in real estate due to their ability to move large amounts of money very quickly, are also usually irreversible. This makes them a perfect vector for criminals, as they can muddy the waters and cover their tracks somewhat by bouncing the funds from bank to bank to bank, before removing them.

This makes mortgage lenders, real estate agents, title companies, and such ripe targets for criminals. Their goal is to infiltrate the company's email systems, and watch and wait for the perfect moment to send out a fake email or call, pretending to be the trusted party. In this case, as in many, the fakes are indistinguishable from the real thing.

According to CNBC, who covered the story and verified it with all the banks involved,

"...Robillard’s funds, which went from a JPMorgan Chase account to ones at Citigroup and Ally Bank, according to people with knowledge of her case who weren’t authorized to speak publicly. Robillard had alerted her bank, Charles Schwab, of the fraud on Jan. 30; within days, an official working in the cyber branch of the San Francisco division of the FBI had this message: “Funds have been located and are frozen,” the official said, according to a Feb. 2 email reviewed by CNBC. “That’s all I’m allowed to tell you.”

After that, months went by with no funds, and no updates. Her dream home went back on the market.

"The FBI told her that once the banks involved had frozen the funds, its role was over, she said. So Robillard became obsessed with advocating for herself, reaching out to elected officials and government agencies including the Federal Trade Commission and the Consumer Financial Protection Bureau.

“Nobody will give you any updates or information,” Robillard said. “I’ve been very assertive trying to get people to help; every week I’m following up with random people on LinkedIn from Chase, I’m filing to the California attorney general, the FTC, the CFPB, but it’s gotten me nowhere.”

Almost six months later, and after CNBC started asking questions, Robillard did get her money back. Most people who fall prey to this kind of fraud do not.

So what could she have done differently?

What can hopeful homebuyers do to make sure this doesn't happen to them?

Verify before sending money. Robillard admitted that she could have been more cautious, and verified with her title company that the request she received was authentic.

In any situation where someone is asking you to send money, (especially large amounts of money!) that you call that person or entity on a phone number you know to be correct (not one listed on the request you received) to verify that they are indeed the ones asking, and the details of payment.

There are other ways to make the process safer for everyone. According to CNBC:

"Robillard also sees ample room for improvement in all the parties involved: Her real estate agent should’ve explained that wire directions would be coming directly from the title company; the banks should’ve verified that the receiving account was that of a genuine title company and not a fraudster; and her mortgage broker should’ve used a secure portal for document sharing."

For the full details on this story, click the button below, or visit

https://www.cnbc.com/2024/07/23/wire-fraud-in-real-estate-silicon-valley-executive-warning.html

NEED HELP?

Talk to us:

NEED HELP? Talk to us:

NEED HELP?

Talk to us:

All Rights Reserved | Soteria, LLC

People Served. Problems Solved.

People Served. Problems Solved.

All Rights Reserved | Soteria, LLC